Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Local variation in rates of return on residential property

1

University of Warmia and Mazury in Olsztyn, Department of Real Estate and Urban Studies, Poland

Submission date: 2025-06-11

Final revision date: 2025-07-11

Acceptance date: 2025-09-29

HIGHLIGHTS

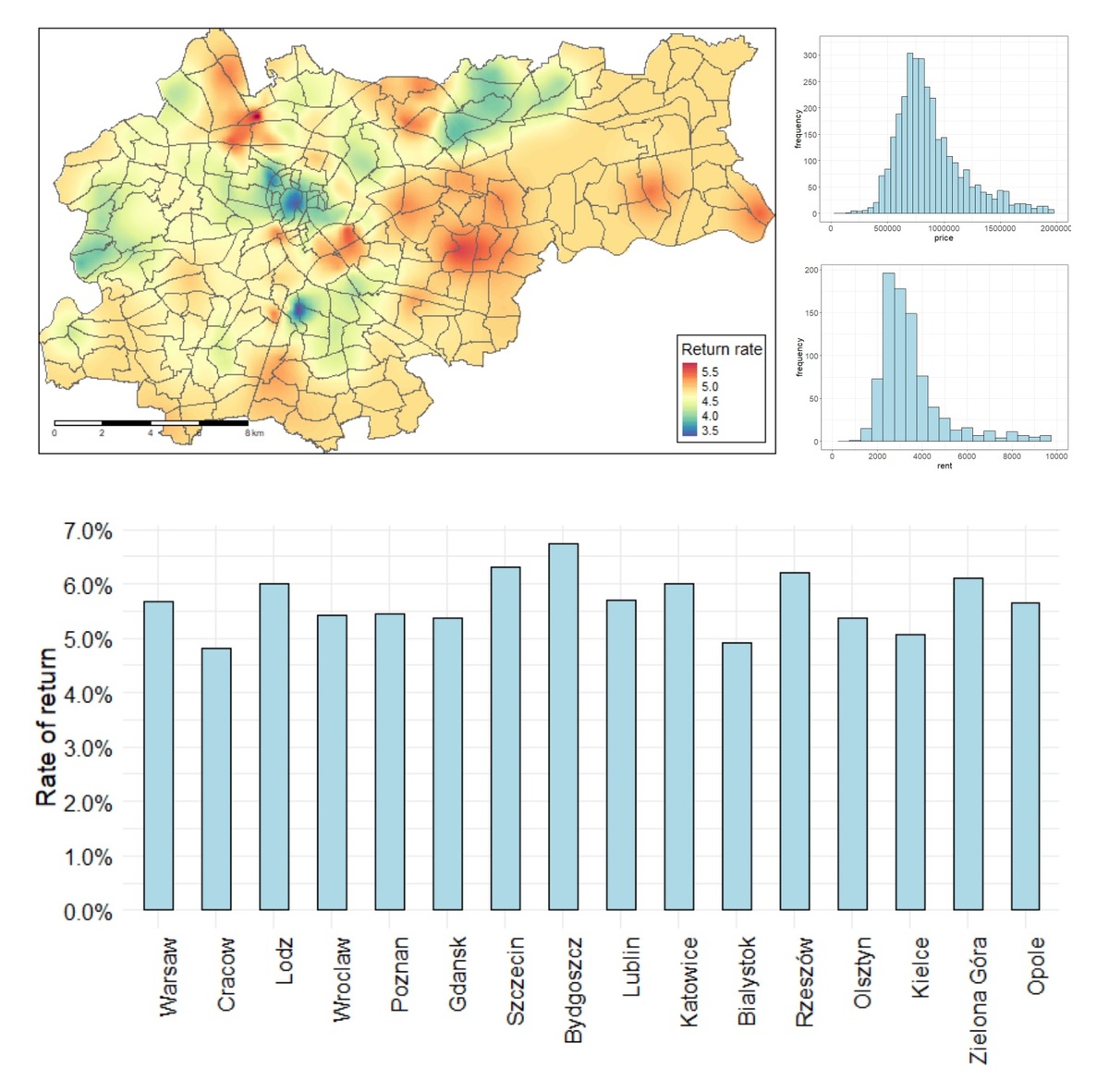

- rates of return on residential property are spatially differentiated

- GWR models allow the spatial variation of returns to be assessed

- rate of return maps can provide important market information

KEYWORDS

TOPICS

ABSTRACT

The rate of return on residential property is determined by a number of diverse factors, including macroeconomic determinants, the level of investment risk, the specific nature of the local market, and the structural characteristics of a particular property. One of the key factors affecting the spread of rates of return at the local level is the location. However, taking location into account in analyses of the rate of return presents significant methodological difficulties due to limitations in traditional calculation methods and analytical models, which generally do not refer to space. The aim of the study is to identify and analyze the spatial variation in rates of return on residential property in selected local markets in Poland, using, inter alia, geographically weighted regression. The methods applied enabled the determination of spatial heterogeneity in the relationship between income and price, which provided the basis for the development of maps showing the spatial distribution of rates of return for the local market area. The results indicate significant differences between individual locations, which emphasizes the importance of considering spatial factors when assessing the attractiveness and risk of investments in the property market.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.