Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

Estimation of the utility function of money and housing based on the cumulative prospect theory

1

Uniwersytet Warmińsko-Mazurski w Olsztynie, Poland

2

Cracow University of Economics, Poland

Submission date: 2023-03-02

Final revision date: 2023-04-23

Acceptance date: 2023-05-31

Publication date: 2023-09-07

REMV; 2023;31(3):83-92

HIGHLIGHTS

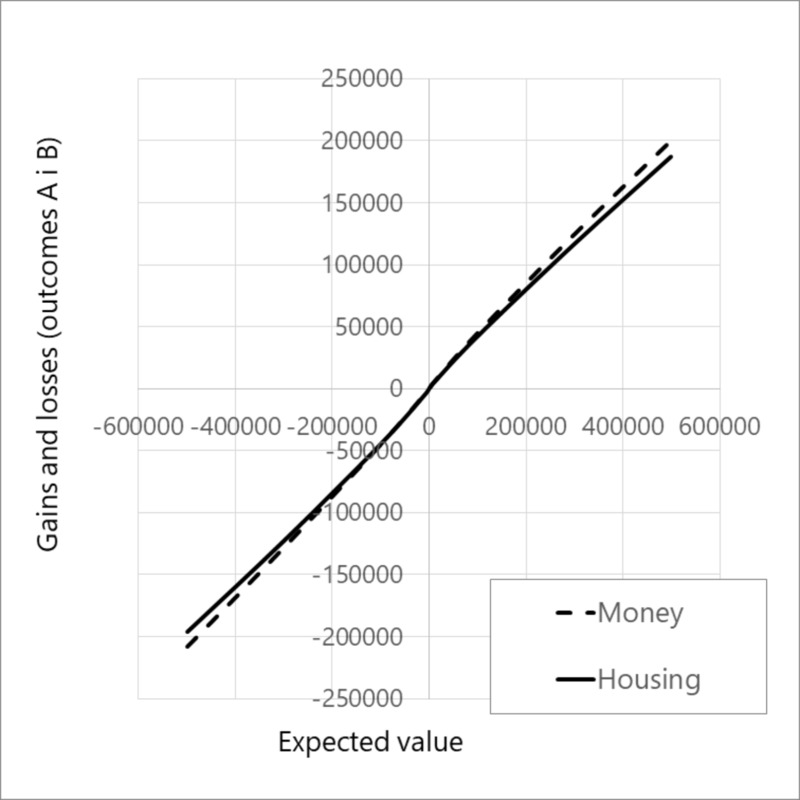

- we estimate the utility function of cumulative prospect theory for money and housing

- we obtain concave function in the gain domain and convex in the loss domain

- the differences in the lambda parameter denoting loss aversion were not significant

- the value of the utility function was somewhat higher for money than for housing

KEYWORDS

TOPICS

ABSTRACT

This article addresses the issue of the utility of money and the utility of housing with a value equivalent to that amount of money. The literature provides many reports on the shape of the utility function for money, but much less research has been devoted to the utility function for housing. The aim of this study was to estimate the utility function of money and housing according to the cumulative prospect theory (CPT) developed by Tversky and Kahneman (1992). Parameters alpha (α), beta (β), and lambda (λ) were estimated to compare the utility value of money and housing. The most important conclusions of the study are as follows: parameters alpha and beta were greater than 0 and less than 1 for both housing and money. Function v(x) was concave in the gain domain and convex in the loss domain, which is consistent with the CPT. The differences in the lambda parameter denoting loss aversion were not significant, and the value of the utility function was somewhat higher for money than for housing. This study was undertaken to estimate the CPT parameters for housing, which, according to the authors' best knowledge, has not been investigated to date.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.