Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Assessing the perceived fairness of a property tax by a taxpayer survey: The case of residential Arnona tax in Israel

1

School of Environmental Sciences, University of Haifa, Haifa, Israel

These authors had equal contribution to this work

Submission date: 2025-06-20

Final revision date: 2025-10-08

Acceptance date: 2025-10-28

Corresponding author

HIGHLIGHTS

- survey examines public perceptions of israel’s arnona property tax system

- most respondents support linking taxes to environmental and service quality

- 91% of participants favor tying tax rates to municipal service performance

- support for socioeconomic-based adjustment varies across income groups

- findings suggest growing demand for fairness in local tax policy design

KEYWORDS

TOPICS

ABSTRACT

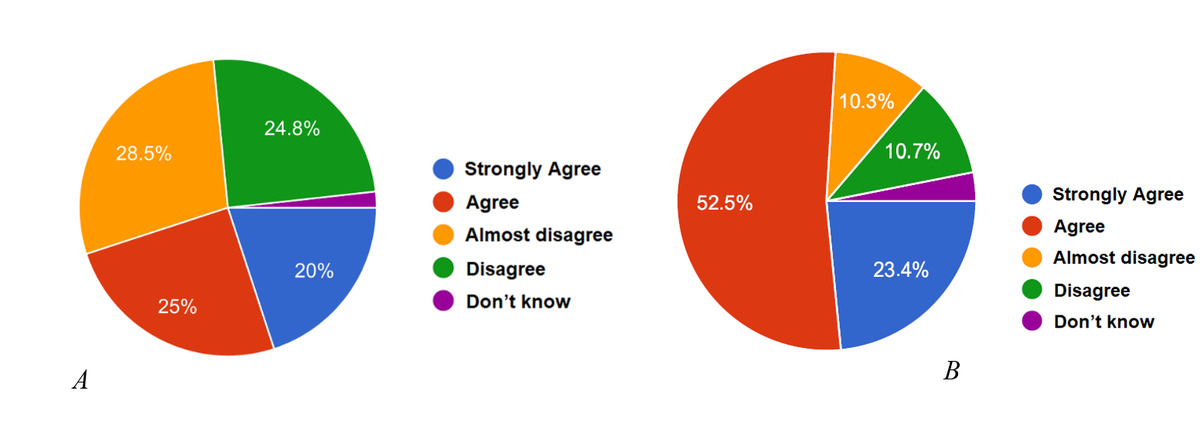

Understanding taxpayer perceptions of a property tax system is essential for developing equitable and transparent fiscal policies that foster public trust. This study explores public attitudes toward Israel’s residential property tax system, also known as Arnona, through an online survey of more than 500 participants, stratified by region of residence, age, income, family status, and homeownership. Although the survey participants were divided regarding the preferred basis for property taxation – a property value - (ad valorem) vs. property size (Arnona) based system, the majority of respondents (~55%) favored the current system, and ~45% supported its value-based alternative. The survey also revealed a wide support for integrating environmental factors into tax assessments, with approximately 75.9% of the survey respondents supporting the idea of incorporating green space access into property tax assessments, and 62.8% of the survey respondents supporting accounting for air quality. Support was even stronger for service-related criteria, with 91.3% of participants supporting the idea of linking the tax rates to the quality of municipal services. However, substantial differences emerged regarding the incorporation of the socioeconomic status of taxpayers into tax calculations. Although 59% of low-income respondents favored this idea, only 33% of high-income respondents supported it. In general, the study underscores the growing public demand for tax models that reflect environmental quality and quality of services, rather than linking property taxes to incomes.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.