Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

Dependence of Housing Real Estate Prices on Inflation as One of the Most Important Factors: Poland’s case

1

Department of Finance, Gdansk University of Technology, Poland

2

The London Academy of Science and Business, United Kingdom

3

Accounting and Taxation Department, Odesa Mechnikov National University, Ukraine

4

Odessa National Economic University, Ukraine

5

Mathematical Methods of Economic Analysis Department, Odessa National Economic University, Ukraine

Submission date: 2022-03-30

Final revision date: 2022-05-15

Acceptance date: 2022-05-31

Publication date: 2022-12-09

REMV; 2022;30(4):25-41

HIGHLIGHTS

- the level of residential real estate prices is related to the inflation rate

- reference rate changes lead to a decline in housing price growth

- 2017 is the moment of the price trend change

- models of multiple linear regressions of changes in the price of 1 square metre of housing on changes in other considered factors affecting the real estate market were built for each of the eight largest cities in Poland

KEYWORDS

TOPICS

ABSTRACT

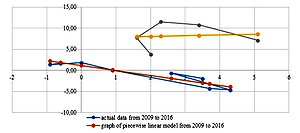

The study aimed to examine the impact of inflation on the real estate market using Polish panel data for the last 13 years. It is based on a panel model, where price changes of one square meter of housing are determined as a function in changes of inflation, the central bank's base rate, dwellings built, as well as new mortgage loans. The quarterly dynamics of the average price of 1 square meter of housing in Poland’s eight largest cities in the 2009-2021 period was studied. This price was modeled and predicted using one of the Box-Jenkins time series models: the Holt-Winter model of exponential smoothing with a damped trend. The forecasting results showed a small (up to 4%) relative error in comparison with the actual data. In addition, the moment (2017) of the price trend change was found. Therefore, piecewise linear regressions with high regression coefficients were used when modeling the impact of inflation changes on the real estate market indicators under consideration. The results obtained provide valuable insight into the relationship of real estate market indicators, allowing consumers to predict available options and make decisions in accordance with their preferences.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.