Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

The dynamics of the impact of the COVID-19 pandemic on Pan-Asia’s real estate investment trusts

1

Faculty of Built Environment and Surveying, Universiti Teknologi Malaysia, Malaysia

Submission date: 2023-03-14

Final revision date: 2023-05-04

Acceptance date: 2023-06-02

Publication date: 2023-12-09

REMV; 2023;31(4):11-22

HIGHLIGHTS

- the study uses the Sharpe Ratio and ANOVA to assess the dynamics of Asian REITs

- all Asian REITs were severely impacted by COVID-19, with J-REITs being hit the most

KEYWORDS

TOPICS

ABSTRACT

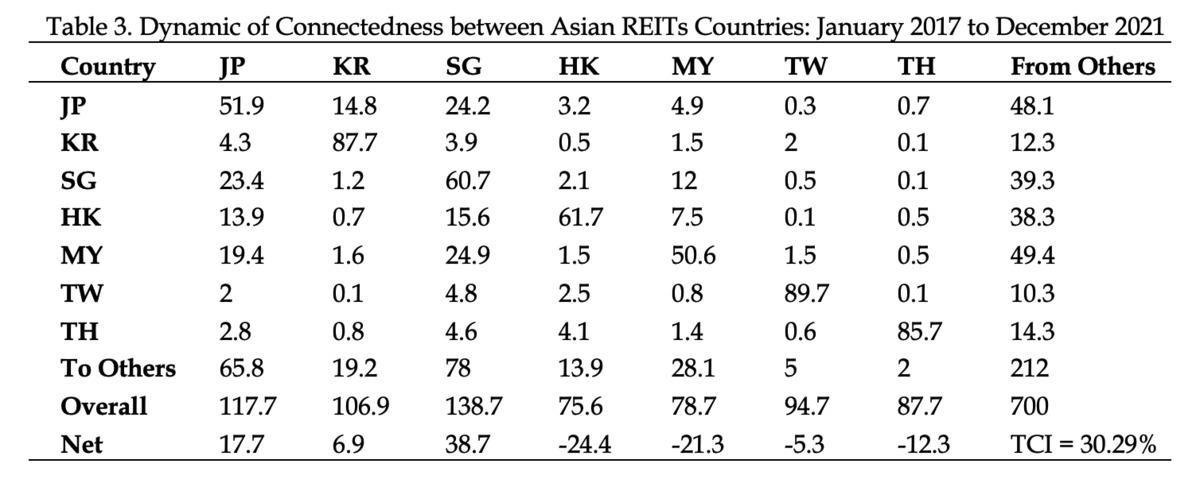

This study evaluated the dynamics of Real Estate Investment Trusts (REITs) in Pan-Asian countries impacted by COVID-19. The countries comprised Malaysia, Thailand, Indonesia, Singapore, Vietnam, South Korea, Japan, China, the Philippines, and Hong Kong. The study aimed to understand how the global crisis affected the real estate industry, specifically publicly traded companies. The COVID-19 pandemic significantly impacted many industries worldwide, including real estate. It caused changes in supply and demand dynamics, disrupted business operations and affected economic activity. The pandemic has also caused a general economic slowdown, with businesses struggling and unemployment rates increasing in some countries in Asia. This in turn has led to reduced consumer spending and lower demand for all types of properties, impacting the overall performance of the Asian REITs market. This study employed techniques such as Sharpe ratio, variance ratio, and Analysis of Variance (ANOVA) to highlight the dynamics of Asian REITs towards the impact of COVID-19. The findings revealed that all Asian countries were severely impacted by COVID-19, with Japan REITs experiencing the highest drop and Taiwan REITs experiencing the lowest decline.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.