Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Why did housing prices rise to a record level in Turkey? An empirical analysis

1

Department of Economics, Kirikkale University, Turkey

2

Department of Economics, OSTIM Technical University, (Ministry of Trade of the Republic of Turkey), Turkey

Submission date: 2023-03-10

Final revision date: 2023-05-04

Acceptance date: 2023-05-31

Publication date: 2023-12-09

REMV; 2023;31(4):1-10

HIGHLIGHTS

- we retrospectively investigates the effect of Covid-19 pandemic and the changes in consumer confidence on housing prices and the volatility of housing prices

- we used the Lee and Strazicich structural break unit root test as a research method

- analysis period of the paper is 2010:q1-2022:q4 quarterly.

- the results show that economic policies and Covid-19 measures have been effective in increasing housing prices

KEYWORDS

TOPICS

ABSTRACT

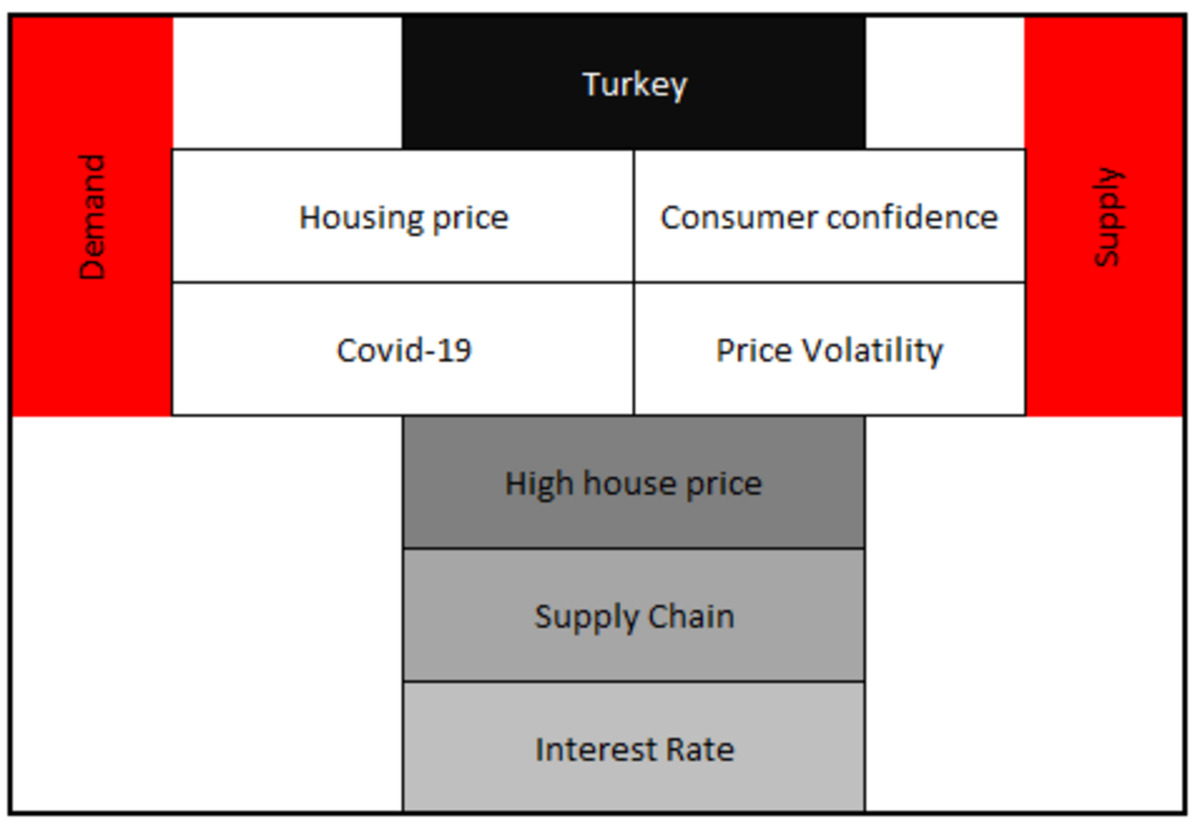

Turkey is one of those countries where housing market has been most severely affected by COVID-19 pandemic. Today the effects of the outbreak have been eliminated significantly. This study retrospectively looks at the days when the world faced a widespread outbreak of a pandemic and investigates the effect of the pandemic and the changes in consumer confidence on housing prices and the volatility of housing prices. Considering the structural breaks in the analysis period (2010:q1-2022:q4 quarterly), we used the Lee and Strazicich structural break unit root test as a research method. The results show that an increase in costs due to a break in the supply chain and containment measures forcing the workforce to stay at home affected the housing supply adversely. It is observable that expansionary economic policies and social assistance programs have a positive effect on housing demand. In this regard, negative supply shock and positive demand pressure are seen to be the determinants of the recent housing price increases in Turkey. However, while there is a positive relationship between consumer confidence and house prices, the effect of house prices on the volatility is statistically insignificant.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.