Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

When developers become lenders: Monetary policy and shadow banking in real estate-driven economies

1

College of Economics and Management, Al Qasimia University, U.A.E.

Submission date: 2025-10-01

Final revision date: 2025-11-15

Acceptance date: 2025-12-23

Corresponding author

HIGHLIGHTS

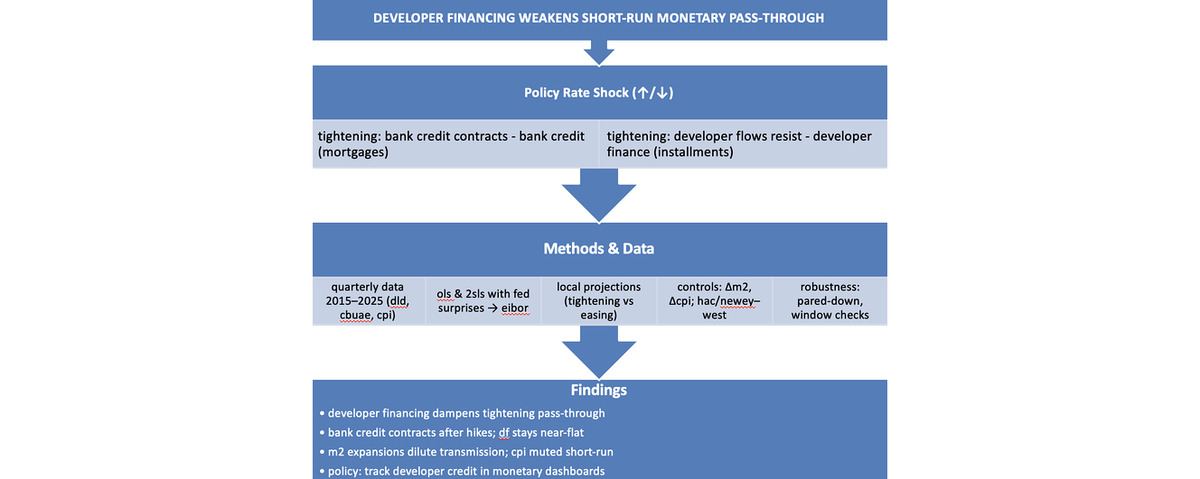

- developer financing weakens interest-rate pass-through

- developer financing weakens interest-rate pass-through

- bank financing strengthens monetary policy effectiveness

- m2-led liquidity expansions dilute transmission; cpi effects are muted

- quarterly 2015–2025 data; ols, 2sls, local projections, fed-shock design

KEYWORDS

developer financingmonetary transmissionreal estate creditDubai housing marketnon-bank creditM2 liquidityCPI inflationpass-through

TOPICS

ABSTRACT

This study examines the macroeconomic effects of Dubai’s growing reliance on developer-financed real estate and its consequences for monetary policy transmission. Using quarterly data for 2015–2025, we estimate Ordinary Least Squares and Instrumental-Variables (2SLS) models, complemented by local projections and an external-shock design. The dependent variable is a monetary policy effectiveness index; key regressors are developer financing and bank financing, with policy rates, inflation (CPI), and money supply (M2) as controls. Robustness is supported by standard diagnostics, and exogenous U.S. Federal Reserve surprises mapped to UAE rates provide identification. Results show developer financing exerts a statistically significant negative effect on policy effectiveness, weakening interest-rate pass-through and increasing liquidity pressures, whereas bank financing contributes positively. Liquidity expansions via M2 further reduce transmission strength, while CPI effects are muted. Dynamic responses indicate bank credit contracts after rate hikes, but developer-led installment flows remain largely unresponsive, confirming a shadow credit channel that circumvents conventional intermediation. The findings imply that non-bank financing should be incorporated into monetary and macroprudential frameworks. For emerging economies where real estate dominates credit formation, bringing developer-led lending into monetary aggregates, supervisory reporting, and stress testing is essential to safeguard policy effectiveness and financial stability.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.