Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

Information asymmetry and fair value accounting: Insights from residential real estate in the UK, Germany, and Spain

1

Department of Finance and Accounting, Mendel University in Brno, Czech Republic

2

Department of Statistics and Operations Research, Mendel University in Brno, Czech Republic

These authors had equal contribution to this work

Submission date: 2025-09-27

Final revision date: 2025-11-28

Acceptance date: 2025-12-06

Corresponding author

HIGHLIGHTS

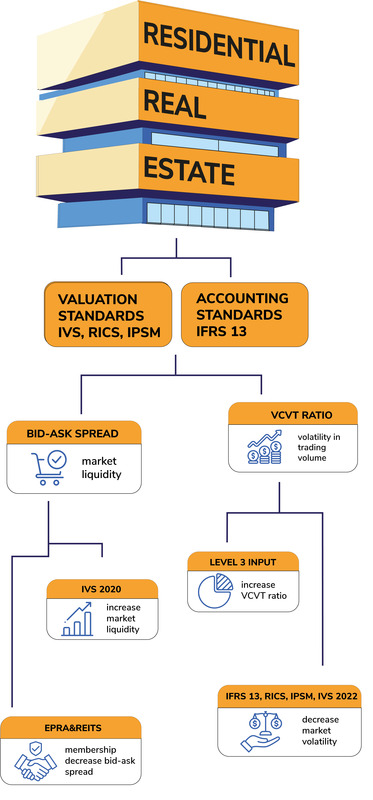

- revisions to IFRS13, IVS2022, RICS2022, IPMS2023 reduced volatility and asymmetry

- IVS2020 update increased bid–ask spreads, suggesting higher market uncertainty

- joint use of bid–ask spread and VCVT shows multi-layer view of asymmetry

- stricter guidance on level3 inputs and diversified valuation enhance market liquidity

- REIT&EPRA membership strengthens disclosure credibility, reduce information asymmetry

KEYWORDS

international accounting standardvaluation standardinformation asymmetryresidential real estateliquidity of stock marketbehavioral finance

TOPICS

ABSTRACT

This study investigates the impact of international accounting and valuation standards (IFRS 13, IVS 2020, IVS 2022, RICS 2022, IPSM 2023) on information asymmetry in the residential real estate markets of the UK, Germany, and Spain. Given the frequent use of subjective inputs in fair value measurements, this sector is particularly susceptible to higher levels of information asymmetry, making it an apt context for analysis. The research analyses changes in selected standards and includes control variables such as company size and market capitalization, using two indicators over the period 2019–2023. Revisions to IFRS 13, IVS 2022, RICS 2022, and IPSM 2023 significantly reduced valuation variability (as measured by the VCVT indicator), confirming their positive effect on market transparency. In contrast, the IVS 2020 update was associated with an increase in the bid–ask spread, suggesting a rise in perceived uncertainty. By jointly examining the bid–ask spread and VCVT, the study provides a comprehensive assessment of how accounting and valuation standards influence liquidity and information asymmetry in the residential property sector - a field that has received limited attention in prior literature. The findings are consistent with earlier research indicating that reduced disclosure requirements can enhance stock market liquidity. Practical implications include recommendations for stricter guidance on Level 3 fair value models and the adoption of best practices from EPRA and REIT frameworks to enhance transparency and credibility in capital markets.

FUNDING

This work was supported by funding of specific research at the Faculty of Business and Economics, Mendel University in Brno, IGA24-PEF-TP-008.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.