Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Transforming megacities: Value and impacts of mixed-use developments with Multi-Criteria Decision-Making

1

Escuela Técnica Superior de Arquitectura de Madrid, Universidad Politécnica de Madrid, Spain

Submission date: 2023-11-01

Final revision date: 2024-02-08

Acceptance date: 2024-03-20

Publication date: 2024-06-10

Corresponding author

Alfonso Valero

Escuela Técnica Superior de Arquitectura de Madrid, Universidad Politécnica de Madrid, Spain

Escuela Técnica Superior de Arquitectura de Madrid, Universidad Politécnica de Madrid, Spain

REMV; 2024;32(2):112-125

HIGHLIGHTS

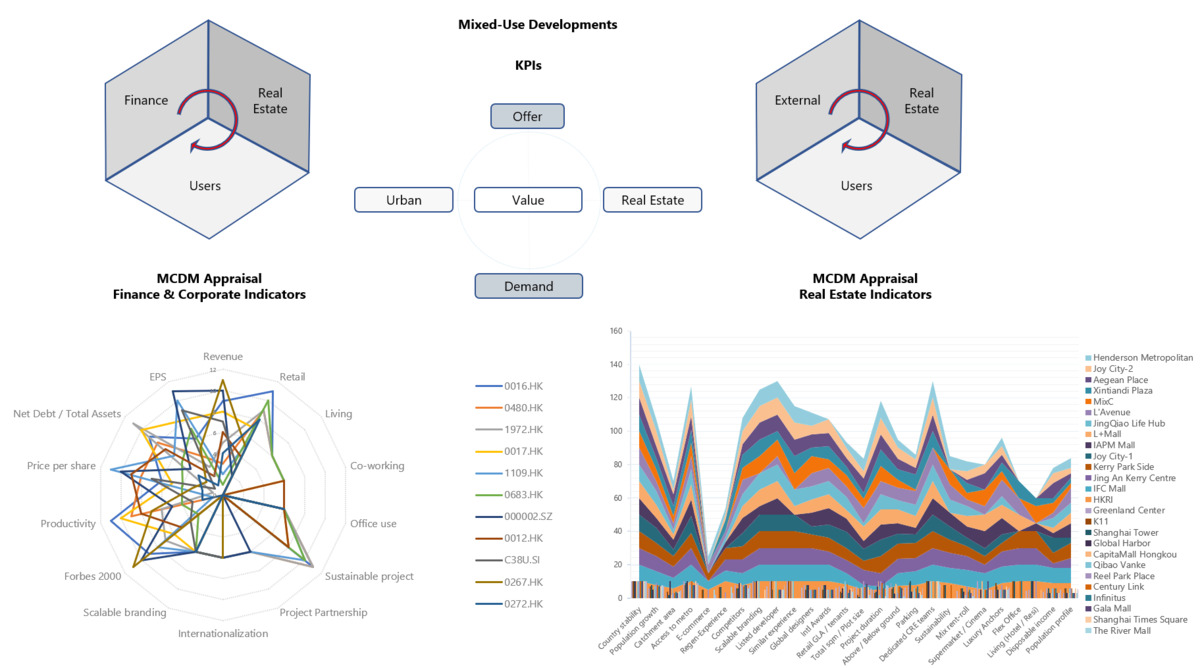

- MCDM evaluation using three sets of KPIs for megacities regeneration

- China's real estate market primarily transformed due to mixed-use assets

- mixed-use buildings adhered to the metro network

- office, retail, hotel, and residential malls increase the value of real estate globally

- listed investors' CBD developments support sustainability initiatives

KEYWORDS

real estate valuationmixed-use developmentsMultiple-Criteria Decision-Making (MCDM)Key Performance IndicatorsESG considerations

TOPICS

ABSTRACT

This research article explores the valuation of mixed-use developments and their impact on urban planning and city regeneration. The study introduces a Multi-Criteria Decision Making (MCDM) methodology to analyze complex buildings developed in Shanghai from 2009 to 2019. Two MCDM appraisals are offered in different developments using three groups of key indicators that served as benchmarks for other Chinese clusters and global megacities. The article addresses two primary research questions: how mixed-use assets can be assessed using MCDM, and what the key performance indicators and factors contributing to the success of mixed-use developments are. The findings highlight the importance of connectivity, previous real estate experience, ESG strategies, international branding, architectural design, financial metrics, and adaptability of the real estate industry in evaluating mixed-use assets. The study provides insight to stakeholders involved in real estate development, including urban planners, developers, and investors, enabling them to make informed decisions and improve sustainable practices. The research also highlights the importance of considering ESG principles, community benefits, and long-term strategies when assessing mixed-use developments to drive social change and contribute to urban regeneration.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.