Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

Housing Cost Stress of Mortgagers And Tenants in Poland

1

Institute of Markets and Competition, Collegium of Business Administration, SGH Warsaw School of Economics, Poland

2

Department of Economic and Social Development, Faculty of Economics and Finance, University of Bialystok, Poland

Submission date: 2021-09-12

Final revision date: 2022-01-18

Acceptance date: 2022-01-27

Publication date: 2022-06-18

REMV; 2022;30(2):61-72

HIGHLIGHTS

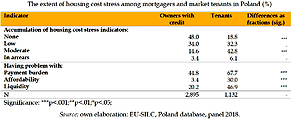

- we compared housing cost stress among mortgagers and market tenants

- following Wladron’s (2016) methodology we develop and apply a housing cost stress indicator

- the results suggest that in Poland, almost one in two mortgage debtors has difficulty meeting housing costs, but the scale and severity of problems is much greater among market tenants

- the results suggest also that the problems particularly affect single households, people without higher education and those with lower incomes, and have a negative impact on their quality of life

KEYWORDS

TOPICS

ABSTRACT

The economic problems of mortgage takers, especially in light of the global financial crisis, is a very important issue both from the point of view of housing policy and the stability of the banking sector. The analysis of the situation of mortgagors is usually limited to determining the percentage of defaulted mortgages. We compared the revealed mortgage repayment problems among Poles (arrears) with the unrevealed ones (such as high housing cost burden, inability to bear unexpected expenses), which we defined as housing cost stress. Next, we compared it with that of tenants at market rates. We found that in Poland, although we observe only a small percentage of mortgagors who are in arrears with their housing costs (about 3%), a large proportion of borrowers (about half of them) is in a difficult financial situation. At the same time, we noticed that their situation is still better than that of market rent tenants, because only one in five renters did not experience problems with covering housing costs. Among tenants, singles were much more likely to suffer from housing cost stress.

ACKNOWLEDGEMENTS

We would like to thank two anonymous reviewers for comments which helped to improve our paper.

FUNDING

This research was funded by Polish National Science Centre (NCN) Grant 2018/31/N/HS4/02333.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.