Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Comparative Analysis: Influence of Interest Rates on Returns of Real Estate Private Equity Index and Real Estate Public Equity Index

1

University Institute of Applied Management Sciences, Panjab University, India

Submission date: 2022-02-01

Final revision date: 2022-05-05

Acceptance date: 2022-05-17

Publication date: 2022-12-09

Corresponding author

REMV; 2022;30(4):17-24

HIGHLIGHTS

- the private equity real estate index generates positive returns when the interest rates continue to go up

- the real estate investment trusts returns are indifferent to changes in interest rates

KEYWORDS

TOPICS

ABSTRACT

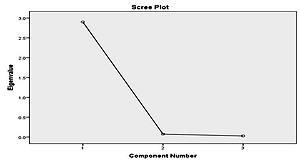

In this paper, we studied the influence of interest rates on a US-based real estate private equity index as well US Wilshire public equity REIT Index. The interest rates that are chosen as independent variables include Monthly LIBOR, Yearly LIBOR and the Federal Cost of Funds Index. The dependent variables include US-based real estate private equity index that includes quarterly returns of 1,035 real estate funds, including liquidated funds formed between 1986 and 2018. The other dependent variable is the US Wilshire REIT Index. The variance of returns of interest rates considerably influences the variance of returns of the US PERE Index, whereas variance of returns of interest rates doesn’t influence the variance of returns of the US Wilshire REIT Index. Also, the real estate index is positively correlated to interest rates and so rising interest rates influence the returns of US PERE Index in a positive manner. The study shows that private equity real estate investors should expect higher return as the cost of funds increase.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.