Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Vacancy rate and rent on the office market in Poland - In search of asymmetry

1

Departament of Financial Markets and Consumer Finance, University of Rzeszow, Poland

2

Departament of of Real Estate and Investment Economics, Krakow University of Economics, Poland

Submission date: 2025-06-23

Final revision date: 2025-10-25

Acceptance date: 2025-11-14

Publication date: 2025-12-11

Corresponding author

Krzysztof Adam Nowak

Departament of Financial Markets and Consumer Finance, University of Rzeszow, Poland

Departament of Financial Markets and Consumer Finance, University of Rzeszow, Poland

REMV; 2025;33(4):96-109

HIGHLIGHTS

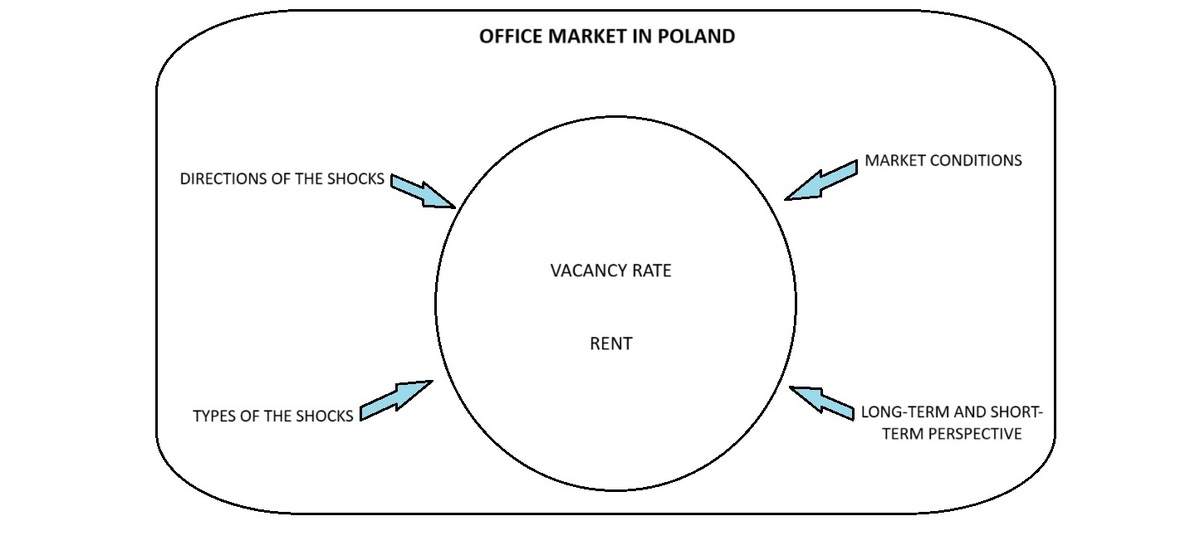

- in the paper, we refer to the asymmetric adjustments of vacancy rate and rent

- we verify impact of direction and type of the shocks on the adjustments

- we investigate impact of market conditions and distinction between long-/short-term

- the article is based on the study of the office market in major Polish cities

KEYWORDS

TOPICS

ABSTRACT

A growing body of empirical evidence suggests that adjustments on the office market are not symmetric. The theoretical framework provides various justifications for the presence of frictions, especially in the case of rent and vacancy rate. In this paper, we investigate the asymmetric reactions of rent and vacancy rate to the demand and supply shocks in the nine major office markets in Poland. In the course of the study we seek answers to two research questions. First, we investigate if the direction (positive or negative) as well as type (demand or supply) of the shocks produce asymmetry in the adjustments of vacancy rate and rent. Secondly, we examine if market conditions and distinction between the long-term and short-term perspective can generate asymmetry in vacancy rate and rent responses to the shocks.

We use quarterly time series starting in 2011 / 2018 in the case of mature markets and markets in the early stage of development, respectively. Our data end in the end/mid- of 2024. In the study, the nonlinear autoregressive distributed lag (NARDL) model is applied. The paper contributes to the discussion regarding nonlinear adjustments on the office markets in Central and Eastern Europe.

FUNDING

Michal Gluszak acknowledges that the research was co-financial from the subsidy granted to the Krakow University of Economics (Project no 076/EEN/2024/POT).

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.