Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

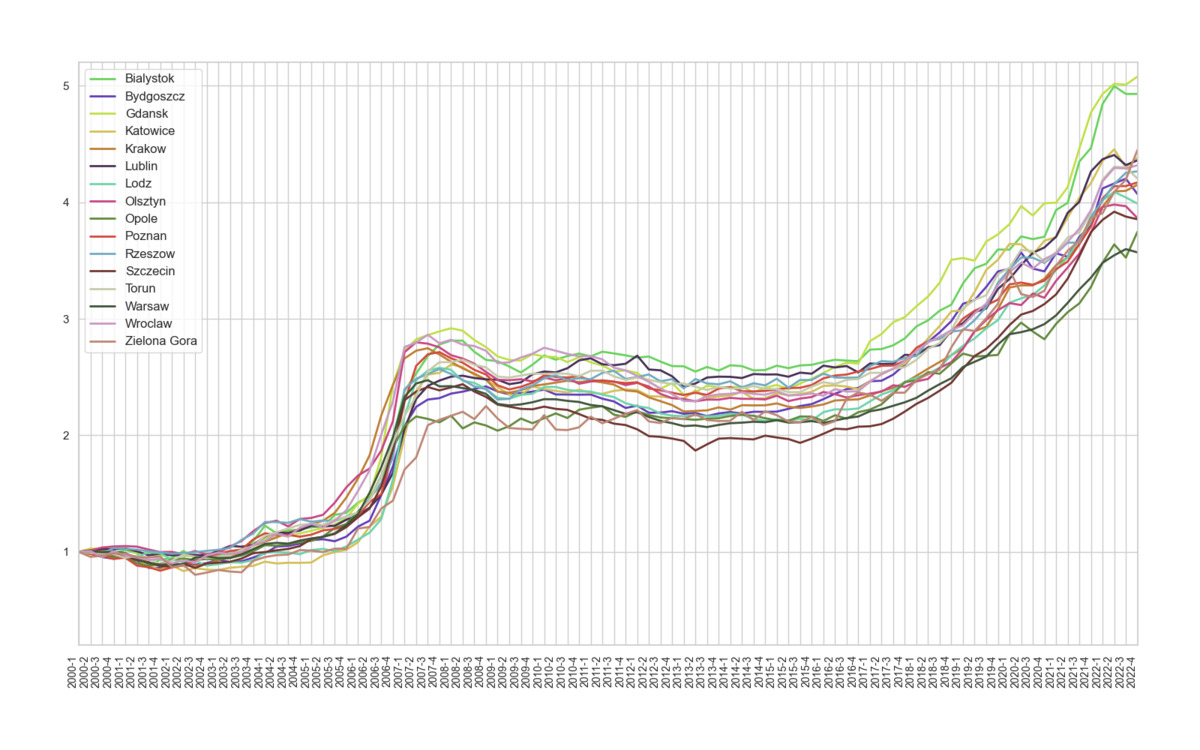

Supply, demand and asymmetric adjustment of house prices in Poland

1

Cracow University of Economics, Poland

2

Poznań University of Economics and Business, Poland

Submission date: 2023-08-21

Final revision date: 2023-12-06

Acceptance date: 2023-12-28

Publication date: 2024-06-10

REMV; 2024;32(2):31-45

HIGHLIGHTS

- house price reaction to the increases in mortgage interest rates is relatively weak and delayed

- house prices responded strongly to the decreases in mortgage interest rates in most of the cities studied

- at least some metropolitan housing markets adjust to demand and supply shocks based on the size of the city

KEYWORDS

TOPICS

ABSTRACT

In recent years, a lot of empirical effort has been made to search for potential nonlinear responses of house prices to various demand and supply factors. This paper examines Poland's heterogeneous regional housing market reactions to key economic variables from 2000 to 2022. The study raises two research questions related to the asymmetric adjustment of housing markets to selected demand and supply shocks.

Firstly, we ask whether the house price adjustments to negative shocks are relatively minor (for example, during an economic downturn) when compared to positive shocks (prevalent in booming markets), mainly due to the loss aversion behavior theory and nominal rigidity of house prices. In particular, we test the hypothesis that house prices react more to positive impulses from supply and demand than negative ones.

Secondly, we investigate whether market reactions are similar for large and small metropolitan markets. The second hypothesis posits that metropolitan housing markets adjust asymmetrically to demand and supply shocks based on the city size (population and housing stock in a given city).

The study uses a nonlinear ARDL model to test the research hypotheses empirically. This paper provides new insights into the nonlinear reactions of house prices to exogenous shocks and adds to the limited empirical evidence from less developed economies.

FUNDING

This work was supported by the National Science Centre of Poland under Grant number: 2017/27/B/HS4/01848.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.