Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

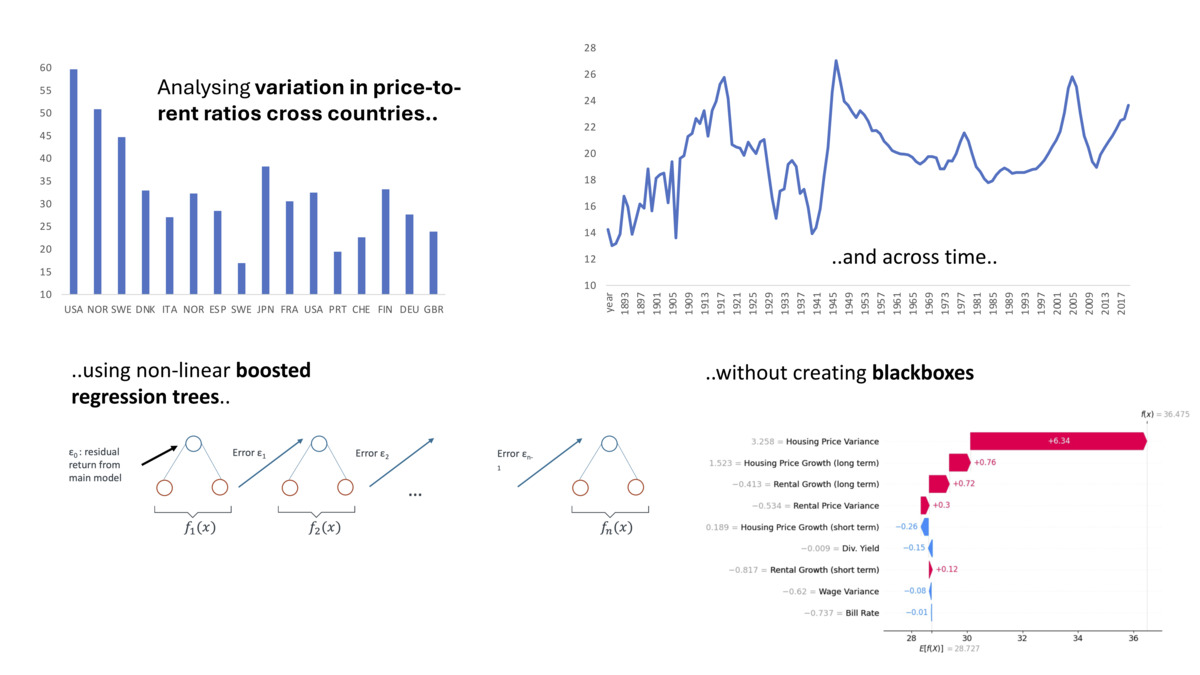

Understanding price-to-rent ratios through simulation-based distributions and explainable machine learning

1

Finance and Data-Science, Duale Hochschule Baden Wurttemberg Mannheim, Germany

Submission date: 2024-10-01

Final revision date: 2025-03-11

Acceptance date: 2025-04-25

Publication date: 2025-09-15

REMV; 2025;33(3):36-48

HIGHLIGHTS

- we estimate the median housing risk-premium to be 3.6

- price-rent-ratios exceed 33 in only 10% of all years

- higher price variances seems to lead to higher PTR-ratios

- higher income variance seems to lead to lower PTR-ratios

KEYWORDS

real estate financeproperty valuationprice rent ratioexplainable machine learningproperty investment

TOPICS

ABSTRACT

Index-level price-to-rent (PTR) ratios are a widely used metric for analyzing housing markets, employed by both real estate practitioners and policymakers. This article seeks to improve the contextualization of observed PTR values by examining the interplay between these ratios and macroeconomic and housing-market developments in a non-linear framework. We analyze historical data on housing prices, rents and macroeconomic developments from 18 advanced economies, spanning from 1870, using Boosted Regression Trees and explainable machine learning techniques. As a precursor to this analysis, we also present the empirical distribution of the price-to-rent ratio and the implied housing risk premia across all years and countries.

Share

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.