Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Optimal Holding Period of an Investment Property Under Different Systems of Income Taxation – an Individual Investor's Perspective

1

School of Economics and Business Administration, University of Tartu, Estonia

Submission date: 2021-11-17

Final revision date: 2022-01-07

Acceptance date: 2022-02-21

Publication date: 2022-09-22

Corresponding author

REMV; 2022;30(3):12-29

HIGHLIGHTS

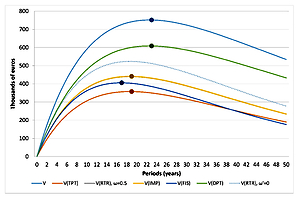

- this theoretical study contributes to the body of research on the implications of distributed profit taxation systems for valuation from a time-related point of view

- our analysis demonstrated that for a natural person under a distributed profit taxation regime, an optimal holding period of the property is the longest and the value of the property is the highest compared with other typical systems

- comparative analysis shows that the divergence between the optimal holding period (and value) under DPT and other tax system augments with increase in the cash flow (earnings) reinvestment rate, cash flow growth rate and the decrease in the investor’s required rate of return

- under zero reinvestment rate of earnings and coequal flat tax rate for both companies and shareholders, the DPT system is no better for an investor than the full imputation system or full integration system in terms of the present value of cash flows and optimal holding period

- it has to be mentioned though that for a natural person, the DPT advantage over other systems of income taxation persists only if personal income tax rate is not (significantly) lower than the corporate income tax rate

KEYWORDS

TOPICS

ABSTRACT

Taxes, particularly income tax, may affect how long investors decide to hold on to an investment property. There exists a research gap regarding the implications of a distributed profit-based taxation system for the holding period of an investment asset. As a distributed profit-based taxation system allows investors to postpone income tax liability, it creates an advantage for investors operating under such a system compared to investors operating under other systems of income taxation. In this paper we model optimal holding periods under different systems of income taxation using a specific type of discounted cash flow model. We show that, theoretically, under the distributed profit taxation system, an optimal holding period for an investment property for an individual investor is the longest (ceteris paribus). This is in concordance with the circumstance that the after-tax value of the property for the investor is highest under the distributed profit taxation system. The results suggest that investment and property development projects under distributed profit taxation are not to be treated in the same way as projects under other tax systems with respect to time. Limitations of the study are related to the deterministic setting of the model as well as some restrictive assumptions.

ACKNOWLEDGEMENTS

The authors acknowledge their gratitude to associate professor Toomas Raus and associate professor Jaan Masso for their invaluable remarks on the paper which helped to improve its quality. We are solely responsible for all errors and omissions.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.