Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Econometric Models of Real Estate Prices with Prior Information. Mixed Estimation

1

Institute of Economics and Finance, University of Szczecin, Poland

Submission date: 2022-03-17

Final revision date: 2022-04-20

Acceptance date: 2022-05-01

Publication date: 2022-09-22

Corresponding author

REMV; 2022;30(3):61-72

HIGHLIGHTS

- in the paper mixed estimation of econometric real estete price models is discussed

KEYWORDS

econometric models of real estate pricesmixed estimationTheil – Goldberger estimatorprior informationland prices prediction

TOPICS

ABSTRACT

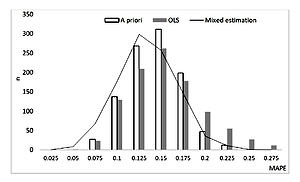

The purpose of this paper is to estimate econometric models with sample and prior information. Prices of land property for residential development in Szczecin are modeled (the price level was determined for 2018). Modeling property prices only based on sample data generates numerous problems. Transaction databases from local real estate markets often contain a small number of observations. Properties are frequently similar, which results in low variability of property characteristics, and thus – low efficiency of parameter estimators. In such a situation, the impact of some features cannot be estimated from the sample data. As a solution to this problem, the paper proposes econometric models that consider prior information. This information can be, for example, in the form of property feature weights proposed by experts. The prior information will be expressed in the form of stochastic restrictions imposed on the model parameters. In the simulation experiment, the predictive power of mixed estimation models is compared with two kind of models: OLS models and model with only prior information. It turned out that mixed estimation results are superior with regard to formal criteria and predictive abilities.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.