Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

A real estate development risk rating model using machine learning and multidimensional data (RED RM)

1

Laboratory of Systems Engineering, Hassania School of Public Works, Morocco

Submission date: 2025-04-12

Final revision date: 2025-08-04

Acceptance date: 2025-09-27

Publication date: 2025-12-11

REMV; 2025;33(4):42-57

HIGHLIGHTS

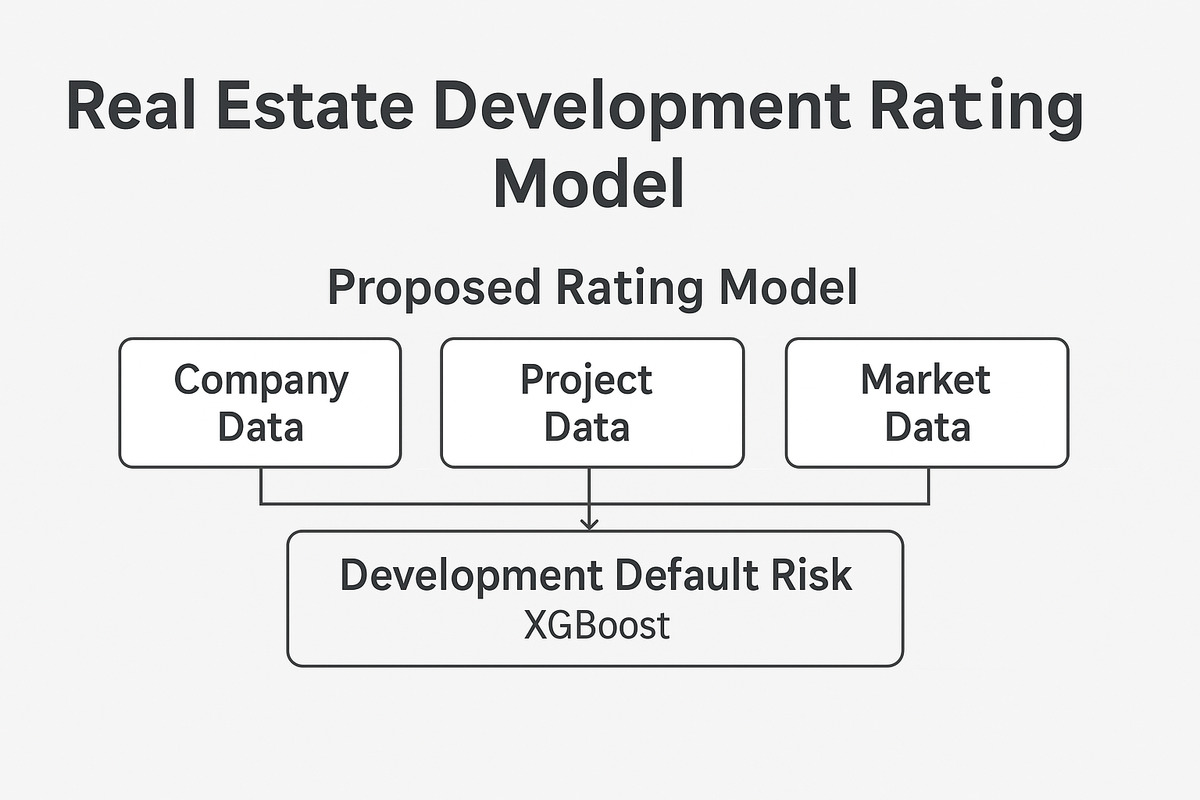

- a multidimensional real estate development rating model with various factors

- companies’ financial data, project ratios, location proximity to amenities

- providing a practical tool for banks and developers

KEYWORDS

TOPICS

ABSTRACT

The real estate sector is a cornerstone of economic development, significantly contributing to GDP and employment. For financial institutions, assessing the creditworthiness of developers and buyers is crucial to mitigate credit risks and maintain financial stability. In this context, the purpose of this study is to propose a model for real estate development rating to enhance the decision-making process. To achieve this, we combined existing data and collected ones with insights from experts, along with a machine learning perspective, to create a multidimensional model, with its features and process, which takes into account companies, projects, and market data. For the proposed grid, the selected features include companies’ financial data, historical behavior, project ratios, location with proximity to amenities, mobility and accessibility, macro market data and other influencing ones. Applied to 653 different cases in Morocco between 2016 and 2025, the rating is based on the XGBoost probability of default and confronted to the effective default to be used by banks and developers.

CONFLICT OF INTEREST

The datasets and code used to develop the RED RM model are not publicly available due to confidentiality agreements. However, anonymized samples and the model’s implementation scripts can be made available by the authors upon reasonable request.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.