Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

The impact of investor sentiment on commercial housing prices and the property stock index volatility in South Africa

1

School of Accounting, Economics and Finance, University of KwaZulu-Natal, South Africa

Submission date: 2022-06-02

Final revision date: 2022-09-04

Acceptance date: 2022-09-27

Publication date: 2023-06-09

REMV; 2023;31(2):1-17

HIGHLIGHTS

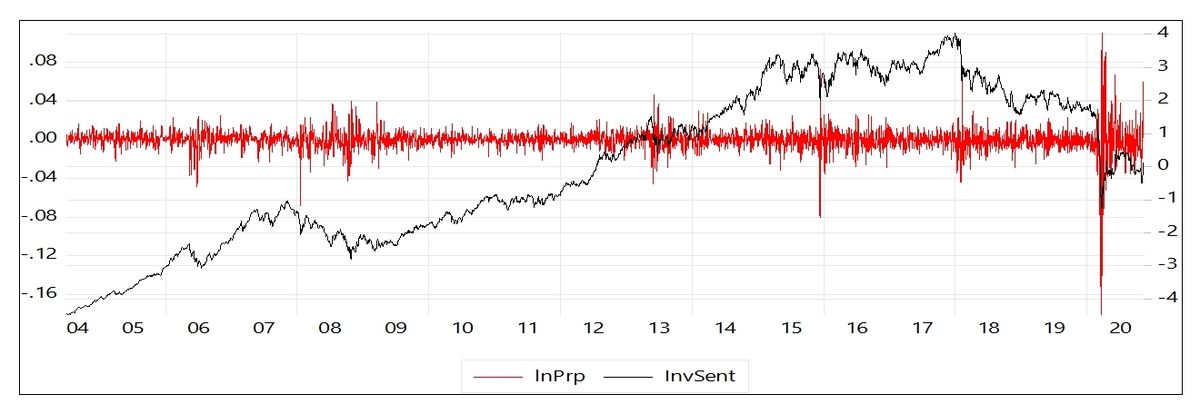

- the conditional volatility of the South African property returns has been established

- this study established that investor sentiment significantly impacts property return volatility

- the effect of investor sentiment on housing index returns is subject to market conditions and varies across housing market segments

KEYWORDS

TOPICS

ABSTRACT

While prior studies have examined the predictive effect of macroeconomic and country risk components on property stock index dynamics, limited explanations exist in the literature regarding the time-varying effect of investor sentiment on housing prices. Accordingly, this study assesses the impact of investor sentiment on the commercial housing properties’ returns and their conditional volatility and the effect of investor sentiment on housing price indices under different market conditions, using GARCH, GJR-GARCH, E-GARCH and Markov-switching VAR models. We found investor sentiment to have a significant impact on the risk premium of the property returns. Recent investor sentiment exerts positive predictive influences on prices of small and medium houses in both bullish and bearish market conditions, but no effect on the large housing market segment. This makes the implementation of risk-related diversification across small and medium real estate portfolios more effective than large real estate portfolios. Our findings show that investor sentiment is a plausible driver of mass investor redemption actions under conditions of uncertainty.

ACKNOWLEDGEMENTS

The acknowledgements intend to recognize individuals who helped with the research, whether this be with language support, writing assistance, proofreading, or other matters).

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.