Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

Residential real estate as a potential hedge of capital against inflation

1

Faculty of Capital Market and Investments, University of Lodz, Poland

Submission date: 2022-05-02

Final revision date: 2022-06-12

Acceptance date: 2022-06-21

Publication date: 2023-03-10

REMV; 2023;31(1):36-42

HIGHLIGHTS

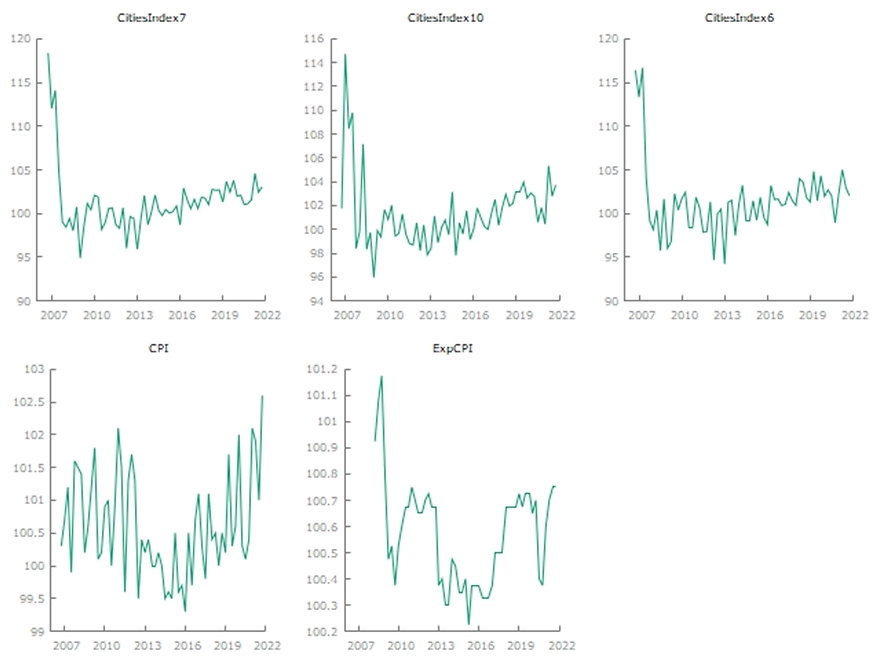

- in order to analyze the relationship between residential property prices and inflation, a cointegration analysis was performed using the Engle - Granger test, with the ADF test

- the study uses three hedonic indices of residential property prices, the CPI inflation index and the expected inflation index calculated by the National Bank of Poland

- real estate prices are not correlated with inflation indices

KEYWORDS

TOPICS

ABSTRACT

There is a belief among investors that real estate is an excellent way to protect capital from depreciation due to inflation. Research does not provide a clear answer as to whether this investors' belief is correct, but some approaches indicate that simple econometric methods are not able, especially in the short term, to clearly indicate the existence of a relationship between inflation and property prices (Fogler, 1984). The purpose of the study –was to find the relationship between residential real estate prices and inflation in the Polish economic conditions. Methodology of the study - the study used cointegration analysis with the Engle - Granger test. The research was carried out in the period from the first quarter of 2009 to the fourth quarter of 2021. The real estate hedonic indices calculated by NBP (National Bank of Poland) and the actual and forecasted inflation rates published by the GUS (Central Statistical Office) and the NBP (National Bank of Poland) were used in the research. The result - the analysis led to a negative verification of the research hypothesis, as it could not be proved that real estate prices were related to the level of inflation during the researched period. Originality/value - the study fills a gap in the Polish market regarding the analysis of the possibility of using real estate as a hedge against inflation. The research concerned only the Polish market, but this issue has not been taken up for years, also in mature economies.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.