Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

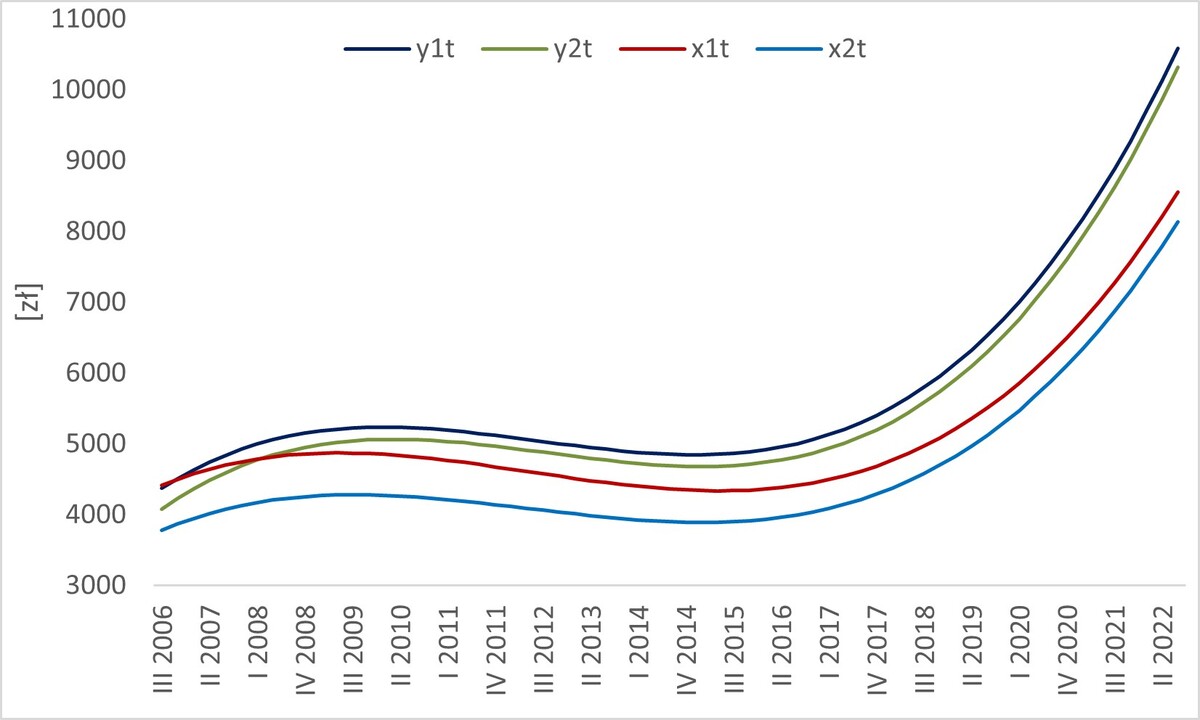

Integration and cointegration of apartment prices on the primary and secondary market in Szczecin in the years of 2006-2022

1

University of Szczecin, Institute of Economics and Finance, Department of Econometrics and Statistics, Poland

Submission date: 2023-03-27

Final revision date: 2023-06-09

Acceptance date: 2023-07-17

Publication date: 2023-12-09

REMV; 2023;31(4):36-44

HIGHLIGHTS

- integration and cointegration (relation) of mean apartment prices on the primary and secondary market;

- transaction prices as well as offer prices;

- ADF test;

- two-step Engle-Granger test;

- procedure entailing analysing (with an ADF test) difference stationarity between prices;

KEYWORDS

TOPICS

ABSTRACT

The objective of the paper is to verify hypotheses regarding integration and cointegration (relation) of mean apartment prices on the primary and secondary market in Szczecin. Both transaction prices as well as offer prices of apartments were investigated. The analysis period encompasses the years of 2006 – 2022 (quarterly data). An ADF test was employed to examine the integration of time series, taking into consideration a deterministic component in the form of a quadratic function. Only the time series of mean offer prices and transaction prices on the primary market proved to be integrated in the first degree. The time series of mean offer prices and transaction prices on the secondary market were not integrated, they occurred to be trend stationary series. A two-step Engle-Granger test was employed to analyze the cointegration of time series, which confirmed the cointegration of mean offer prices and transaction prices on the primary market. The relations between individual price types were examined with the use of a procedure which entailed analyzing (with an ADF test) difference stationarity between prices. From the empirical studies it arises that, in Szczecin, transaction and offer prices on the primary market follow one another. On the secondary market, offer and transaction prices are trend stationary and they converge. On the other hand, prices on the primary market diverge from prices on the secondary market (the primary market diverges from the secondary market). This concerns both offer prices as well as transaction prices.

FUNDING

Project financed under the program of the Minister of Science and Higher Education under the name "Regional Initiative of Excellence" in the years 2019 – 2022, project number 001/RID/2018/19, financing amount 10,684,000.00

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.