Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Capitalization rate and real estate risk factors: An analysis of the relationships for the residential market in the city of Rome (Italy)

1

School of Engineering, University of Basilicata, Italy

2

Department of Civil, Environmental, Land, Building Engineering and Chemistry, Polytechnic University of Bari, Italy

3

Department of Architecture and Design, Sapienza University of Rome, Italy

Submission date: 2024-01-17

Final revision date: 2024-05-03

Acceptance date: 2024-05-14

Publication date: 2024-09-10

Corresponding author

Debora Anelli

Department of Civil, Environmental, Land, Building Engineering and Chemistry, Polytechnic University of Bari, Via Orabona 4, 70125 Bari, Italy

Department of Civil, Environmental, Land, Building Engineering and Chemistry, Polytechnic University of Bari, Via Orabona 4, 70125 Bari, Italy

REMV; 2024;32(3):101-115

HIGHLIGHTS

- the usefulness is the possibility of supporting valuers in determining the capitalization rate of residential sector

- interpret and describe the capitalization rate determination of the residential sector at the sub-municipal scale in a clear and rigorous manner

- the obtained outputs can be used to classify the investment risk according to the main factors selected by the model

KEYWORDS

capitalization ratereal estate riskexogenous shockincome-producing propertiesreal estate assessmentregression model

TOPICS

ABSTRACT

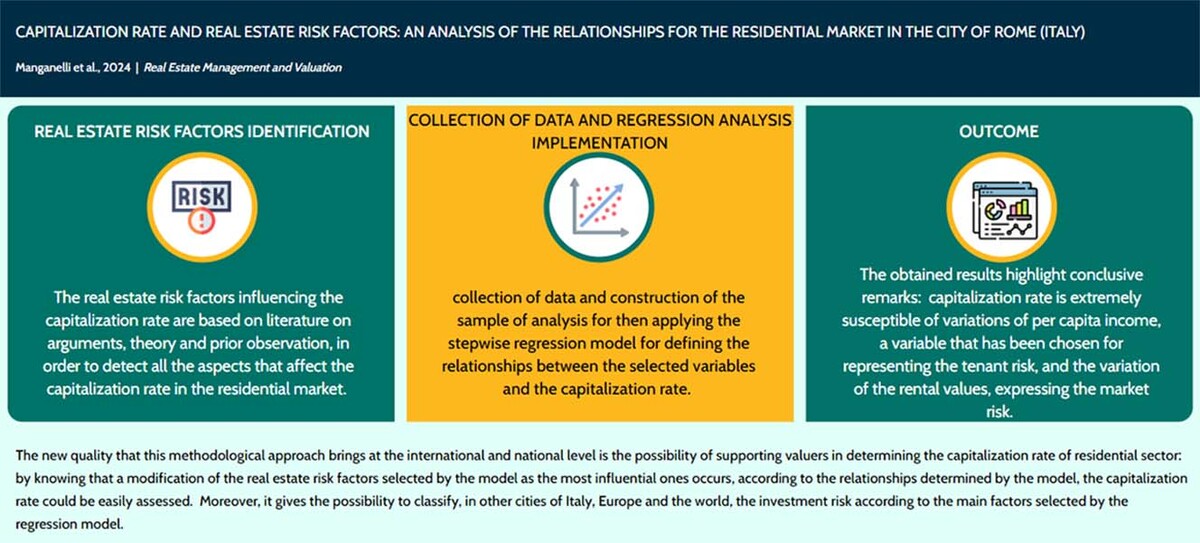

The assessment of income-producing properties - considered as the bulk of the existing assets - has rapidly increased. An efficient assessment of the market value of this kind of properties requires an adequate involvement of the main risk factors of the local real estate market for the determination of the capitalization rate for the income approach application. The aim of the work is to identify the most significant local real estate risk factors related to the market, the tenant and the context on the residential capitalization rate. The development of a regressive methodological approach applied to the residential sector of the city of Rome (Italy) is proposed. The obtained results show the susceptibility of the analyzed capitalization rate to the variation of the local real estate risk factors, in particular the per capita income and the variation of the rental values, by also considering the influences of the exogenous shocks and the expectation of the investors. The practical implications of the work consist in the possibility for evaluators to assess the likely changes in the capitalization rate in different residential contexts if variations occur in the most influential local risk factors identified by the proposed model.

FUNDING

The current study has been developed within the current research P.R.I.N. Project 2022: “INSPIRE—Improving Nature-Smart Policies through Innovative Resilient Evaluations”, Grant number: 2022J7RWNF

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.