Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

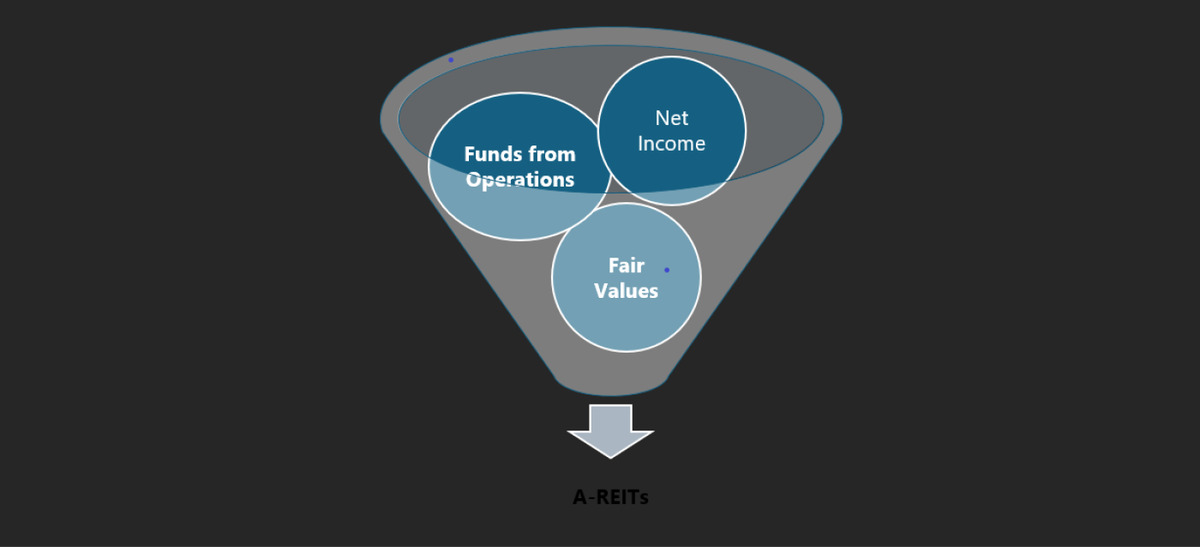

A-REITs value relevance of performance measures: Net income, funds from operations and fair values of investment property

1

School of Business, Western Sydney University, Australia

Submission date: 2024-11-02

Final revision date: 2025-02-13

Acceptance date: 2025-05-14

Publication date: 2025-09-15

REMV; 2025;33(3):1-10

HIGHLIGHTS

- Australian Real Estate Investment Trusts (A-REITs)

- funds from Operations

- net Income

- fair value of investment property

KEYWORDS

Net IncomeAustralian Real Estate Investment Trusts (A-REITs)Funds from OperationsFair Value of Investment Property

TOPICS

ABSTRACT

This study investigates value relevance of three-performance measures (net income (NI), funds from operations (FFO), and fair values on investment property (FVIP) on stock prices of Australian Real Estate Investment Trusts (A-REITs). Using data from A-REITs over the period 2012–2021 and estimating a panel system Generalized Method of Moments (GMM), results suggest that of the three, only net income is significantly and positively related to the stock prices of A-REITs. The implication of this study for investors and fund managers is that net income is the most important accounting number that investors look for in the financial statements of A-REITs.

ACKNOWLEDGEMENTS

The authors express their gratitude for the valuable comments provided by the anonymous referee.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.